Is your brand an Amazon Vendor? If so, you need to be monitoring your account for wrongful chargebacks.

Customers can initiate chargebacks for any reason, not all of them valid. That why it’s so important to proactively protect your accounts.

In this guide to Vendor Central chargebacks, we dive into the top solutions for monitoring your brand accounts and securing refunds from Amazon.

Table of Contents

ToggleWhat are chargebacks on Amazon Vendor Central?

Chargebacks are essentially a mechanism through which a customer disputes a charge made to their credit or debit card. In the context of vendors selling through Amazon Vendor Central or any other ecommerce platform, chargebacks typically occur when a customer disputes a transaction related to a purchase made through the platform. These disputes can arise for various reasons, including:

- Fraudulent transactions: If a customer’s credit card information is stolen or used by a minor in the house without authorization, they may dispute the charges, resulting in a chargeback.

- Billing errors: Customers may dispute charges if they believe they were incorrectly billed, charged an incorrect amount, or charged double.

- Product not as described: If a customer receives a product that does not match its description or is damaged or defective, they may initiate a chargeback to seek a refund.

- Failure to receive goods or services: If a customer does not receive the goods or services they paid for, they may dispute the charge.

Of course, most Amazon customers utilize customer support for issue resolution, but some customers will initiate chargebacks directly with their credit card company.

When a customer initiates a chargeback, the credit card issuer investigates the dispute and may temporarily reverse the transaction. The vendor then typically has an opportunity to respond to the chargeback, providing evidence or documentation to support their case. Depending on the outcome of the investigation, the chargeback may be either upheld or reversed.

For vendors selling through Amazon Vendor Central, chargebacks can have significant financial implications and can result in millions of losses just in one year.

Why Amazon vendors need to monitor chargebacks

Amazon vendors take advantage of traditional retail relationships with Amazon, selling products from the brands under their care directly to Amazon, which in turn handles logistics, fulfillment, and customer service.

First-party Amazon vendors typically have far more daily transactions than third-party sellers, leading to complexity when it comes to accounting and monitoring your account for errors.

Amazon will make you responsible for most chargebacks, even when it’s not fair. It’s up to each individual vendor to check which chargebacks should be on Amazon’s dime, not their own.

Chargebacks are one of the most costly fee errors for vendors. According to our experience working directly on reimbursements, Amazon vendors lose 5% of monthly revenue due to chargebacks, unrecovered funds, and financial inaccuracies.

When selling on Amazon, it’s essential to take full responsibility of your account. By disputing problematic chargebacks, you can recover lost funds due to customer dishonesty, Amazon’s negligence, or other issues outside of your control.

3 solutions for managing Amazon Vendor Central chargebacks

You have a few different options to choose from when managing chargebacks regularly.

1. Partner with a done-for-you reimbursement service

The first option is to work with a reimbursement service experienced in serving Amazon vendors (not just third-party sellers). A done-for-you service will handle account monitoring, claim filing, customer support communication, and reimbursement tracking. These services typically charge a commission of all successful refunds.

Chargebacks are just one category of Vendor Central refunds, so make sure you’re working with a company that oversees all potential losses.

Vendor Central reimbursement claims can be filed dating back 3 years, and an experienced reimbursement service is your best bet at securing the maximum.

Example: Refunds Manager

Refunds Manager offers a dedicated reimbursement service for Amazon vendors. We use a combination of our own proprietary software and hands-on account auditing for superior accuracy. We crawl your account for the following errors: COOP/MDF fees, chargebacks, shortages, transportation issues, invoices and pricing, shipping notification fees, shipping and receiving, damaged allowance, Amazon receivables, package preparation fees, and more.

We manually open cases on your behalf and deposit reimbursements from Amazon directly into your account.

2. Work with accountants

Another option is to hire full-time accountants who will track your Amazon Vendor transactions and dispute problematic chargebacks. One of the plus sides is that you’ll know how much you’ll be paying each hire in terms of their salary and benefits. While you know the cost, you don’t necessarily know how much they’ll be able to recover for you, so there’s no guarantee of ROI. It can take a long time to train an accountant in Vendor Central chargebacks and other disputes, meaning that it could be months before you see a return on the cost of their employment. What’s more, internal hires can get pulled in other directions or utilized by other managers, meaning this person may not be able to commit all of their time to reviewing your brand’s Vendor Central accounts.

Example: Alliance Resource Group for full-time accounting hires

Alliance Resource Group specializes in headhunting expert accountants and finance managers. You can get in touch with them or a similar recruiting firm to find people who have experience dealing with Amazon Vendor Central.

3. Use software to monitor your account

You can also power up your internal review process with software. Various platforms allow you to monitor chargebacks and other discrepancies. However, they don’t offer a comprehensive review of your entire account the way that done-for-you reimbursement services do. Most platforms also don’t offer features for reimbursement claims, so you’ll need to track and manage those separately.

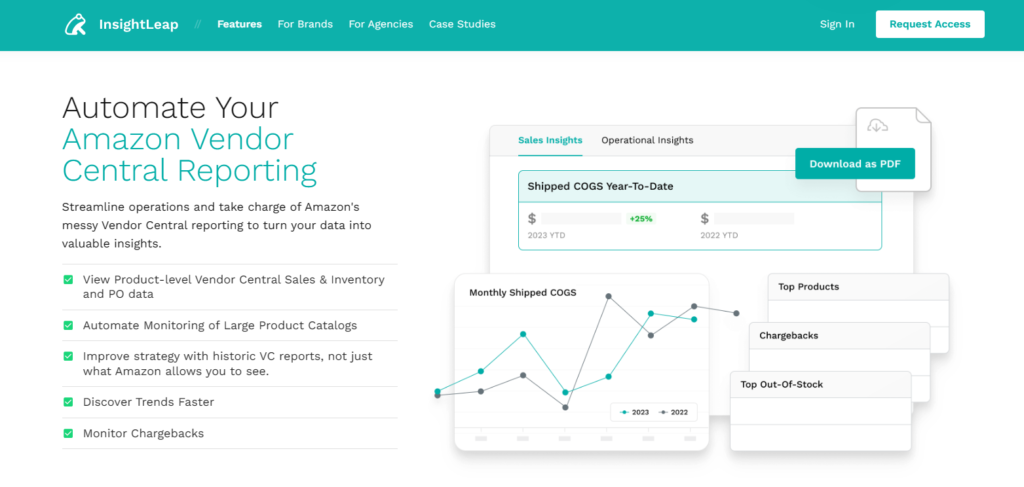

Example: Insight Leap

Insight Leap offers multiple features for automating Vendor Central reporting, including the ability to view product-level sales data, automate the monitoring of large product catalogs, discover trends, and monitor chargebacks.

Key takeaways

Chargebacks represent a complicated accounting issue for Amazon vendors and can represent hundreds of thousands in lost profit per year.

For the most comprehensive, sure-fire approach to securing reimbursements for chargebacks and other issues, partner with a reimbursement service.

Make sure to choose a service that covers all of the main Vendor Central issues. The service should also be able to recuperate lost profits dating back 3 years.